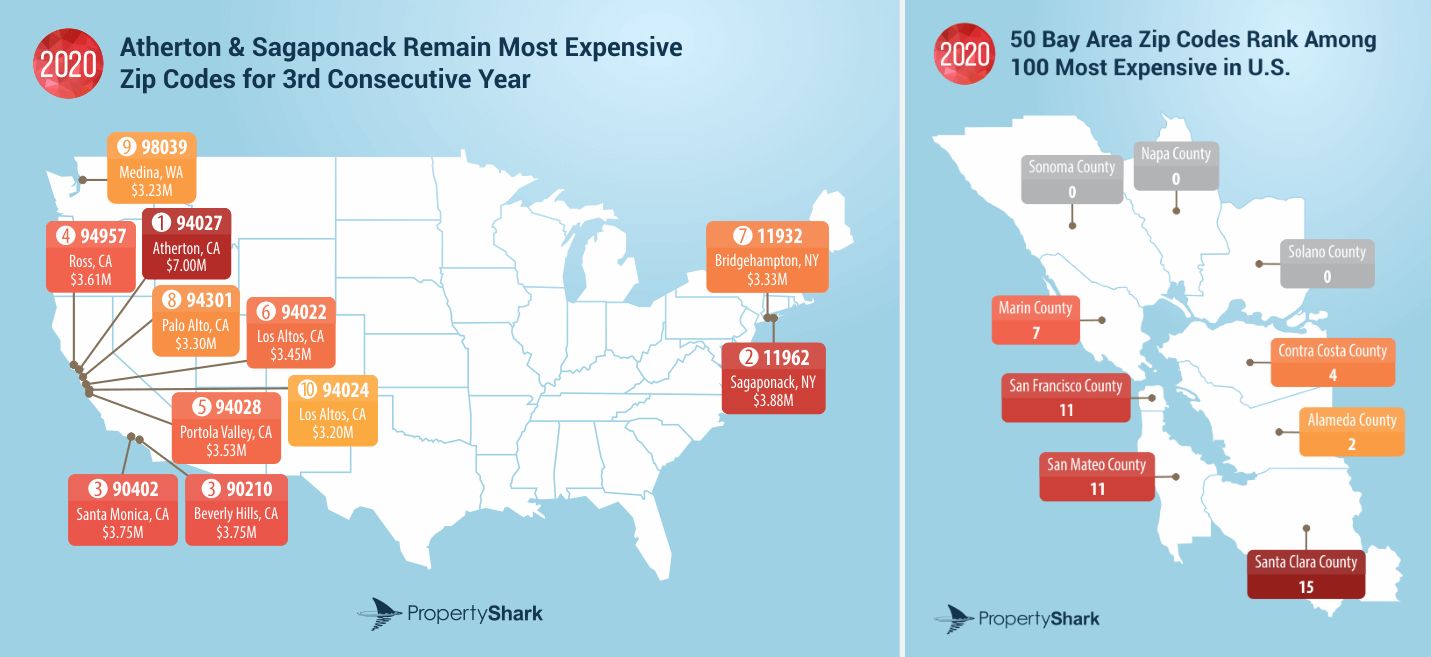

There is no question that cost of living – from the your receipt at the grocery store all the way up average price tag of property – is high here in California. In fact, of the 125 most expensive zip codes to buy real estate in America, 87 are in our state - down from 91 in 2019, according to PropertyShark. Further, 50 of those top zip codes with the highest medium real estate sale prices fall within the Bay Area.

Without doubt, changes in these rankings were plentiful throughout the pandemic. The top Marin County real estate agents were sure to celebrate on news that the small town of Ross skyrocketed from #10 nationally in 2019 - below Atherton, Palo Alto, and Los Altos in the Bay Area, to #4 overall in 2020. Atherton still sits at the top of this list with a median home sale price nearly double the next municipality down (Sagaponack, NY), but Ross leapfrogged Palo Alto and Los Altos, here in the Bay Area, but even surpassed New York City.

The truth, as they say, is in the pudding. Well, in this case, it’s in the numbers. Eight of the ten most expensive North Bay markets were from Marin County. Two more were from Napa County. Marin County placed fifth in the market among the Bay Area’s most expensive: Ross, Belvedere Tiburon, Stinson Beach, Greenbrae and Larkspur. The community saw its median grow by 75% between 2014 and 2018. With more and more limited space to buy or to build, these numbers will surely rise over time.

In the most recent March 2021 Marin Report, the median sales price for single-family, re-sale homes set a new high of $1,822,500 last month. It was up 37.9%, year-over-year. The average sales price also set a new high of $2,295,910. It was up 37.1% from last March. Even the price for condominiums, which the median price for rose 8.4%, year-over-year is on the rise. The average price is up 30.8% over the past year.

With builder confidence reaching a two decade high at the end of 2019, it’s very possible to see home builders increasingly ramp up on production. Yet, as the United States slowly gets itself out of the age of COVID-19 and arrives at a new "normal," it could take the market 4 to 5 years to get out of its past undersupply and back to equilibrium. That is assuming all other economic factors remain the same. On average, builders need buyers to enjoy 2-3 years of solid income streams for a down payment as well as confidence in their financial stability 2-3 years down the road. If the economy can find a new a new, stronger footing, the housing market and its prices will likely boom once again.

Though few can afford a $25 million price tag, homebuilders and normal buyers could find themselves in a sweet spot to purchase their dream home at a reasonable price before take-off this next decade.