London Breed shook the tree at City Hall, and produced $50 million in loans and $12 million in grants for a very substantial small business COVID-19 economic relief package.

The US Congress totally took forever to pass the “skinny relief” bill with another round of Paycheck Protection Program (PPP) loans, and along with them, a crappy and underwhelming $600 stimulus check for each taxpayer. Governor Newsom did recently enact some COVID-19 small business relief grants, but these too are like a band-aid where a tourniquet might be required. San Francisco mayor London Breed just announced a local round of small business relief that looks far more generous and better targeted, as the Examiner reports she just introduced a $62 million SF small business relief package, which is about $50 million in loans, but also $12 million in just straight-up grants. Breed details is all in a long and wonky Medium post, but we’ve got the announcements and a Cliff Notes explainer below.

Her announcement begins at the 2:45 mark in Tuesday’s daily COVID-19 press briefing seen above. “Today, we are unveiling a new plan that will provide significant relief for our small businesses mostly impacted by COVID,” she says. “This new plan will include a mix of $62 million in grants and loans that will be available for businesses most impacted by COVID. These are businesses who have not been able to open their doors, or have been severely limited in the services they can provide. We’re talking about our restaurants, our nail services, our bars, our nightlife venues, our gyms.”

Breed claims this new infusion triples the amount of support provided in small business aid to businesses that cannot operate under the current purple tier unpleasantness, or have been yanked around by ever-changing restriction orders.

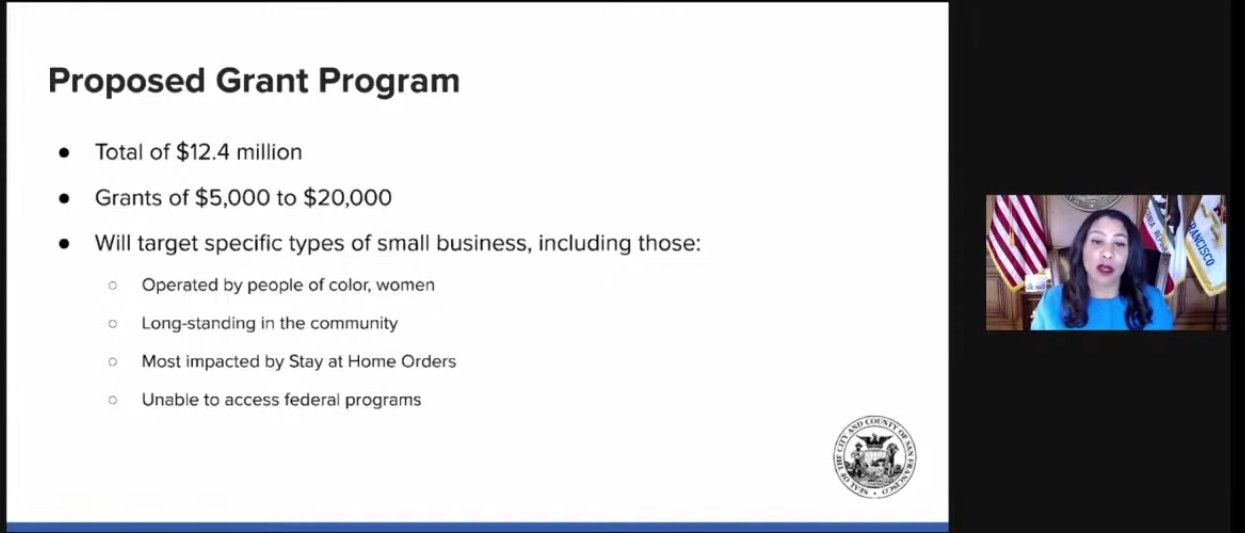

The most generous aspect of the relief package is the $12.4 million in grants, free money which does not need to be paid back, and can range from $5,000 to $20,0000 per business. Priority will go to businesses owned by women or people of color, long-standing businesses, and those most impacted by stay-at-home orders. They’ll also consider businesses who don’t have access to federal relief programs. (Like pot dispensaries?) Breed wants these grants going out as soon as February, which is less than three weeks from now.

The loans are slated to come out to an estimated $50 million total. These will supposedly come with very low interest or even zero interest, and will prioritize what Breed calls “anchor community businesses” that employ more people, and as such, are often shut out of small business loan programs for being too big. There is also an intention to set aside microloans for smaller businesses who, again, find themselves ineligible for federal relief.

Breed’s package would need Board of Supervisors approval, but when she addressed them at Tuesday afternoon’s meeting, the supes all sounded highly supportive. District 6 supervisor Matt Haney was particularly jazzed that these funds could help shuttered nightlife venues for whom he has a separate bailout initiative.

“Part of the focus of our small business recovery funds are also specifically targeted at [nightlife venues],” Breed told the board, “to ensure that they get the resources they need now, so that when the time comes, they are still able to be around to provide what we all know and love, which is an incredible and exciting time in San Francisco.”

Mayor Breed asked city departments to see how much fat they could trim in the short term to finance this relief package, and the total she got in return is impressive. Should the money go out quickly and effectively, this is likely a big win for her. But there’s no guarantee there won’t be red tape or snafus, and we reiterate that the proposal is not yet approved by the board. But if and when that happens, application forms processes should materialize quickly.

Related: Bay Area Music Venues and Theaters Can Apply For Lifesaving Grants Under New Stimulus Bill [SFist]

Screenshots: SFGovTV via Youtube