In the history of San Francisco real estate, the lows never drop too low or last too long. Will this time be different?

The number of single-family homes on the market just hit a nine-year high this week, as Socketsite reports. And with the number of condos changing hands typically about 60-percent higher than single-family homes in a normal year, the flood of condos onto the market hit a nine-year high back in mid-July. The overall inventory of homes for sale was nearing a two-decade high as of last week, and hit a 15-year high this week, per the Chronicle.

"While the market for condos tends to be more volatile, with higher highs, lower lows and faster swings between the two, it remains a leading indicator for the market as a whole," Socketsite writes.

Another indicator of how flooded the real estate market in SF is right now: On Wednesday, the percentage of homes on the market that had seen at least one price reduction rose to 31 percent. A total of 595 properties had seen their prices slashed, which is more than three times the number that had needed price reductions at this time last year, per Socketsite.

Properties are still selling, but unlike in typical years in San Francisco, "the inventory is increasing so much faster than the sales rate," as Compass real estate analyst Patrick Carlisle tells the Chronicle.

As one might expect in a pandemic where downtown offices have been deserted for seven months, the properties mostly likely to be sitting on the market for weeks or months are condos in downtown high-rises.

And the sales that are happening, particularly among larger properties in more desirable neighborhoods, are being driven by affluent buyers taking advantage of the market and their healthy stock market returns this year, the Chronicle notes. So in that regard, things aren't all that different in SF real estate — but a few lucky people are perhaps getting some decent deals.

Anyone looking to sell a home in SF right now is cautioned to price it competitively and stage it well, or it's likely to get buried in the pile of new things hitting the market each day.

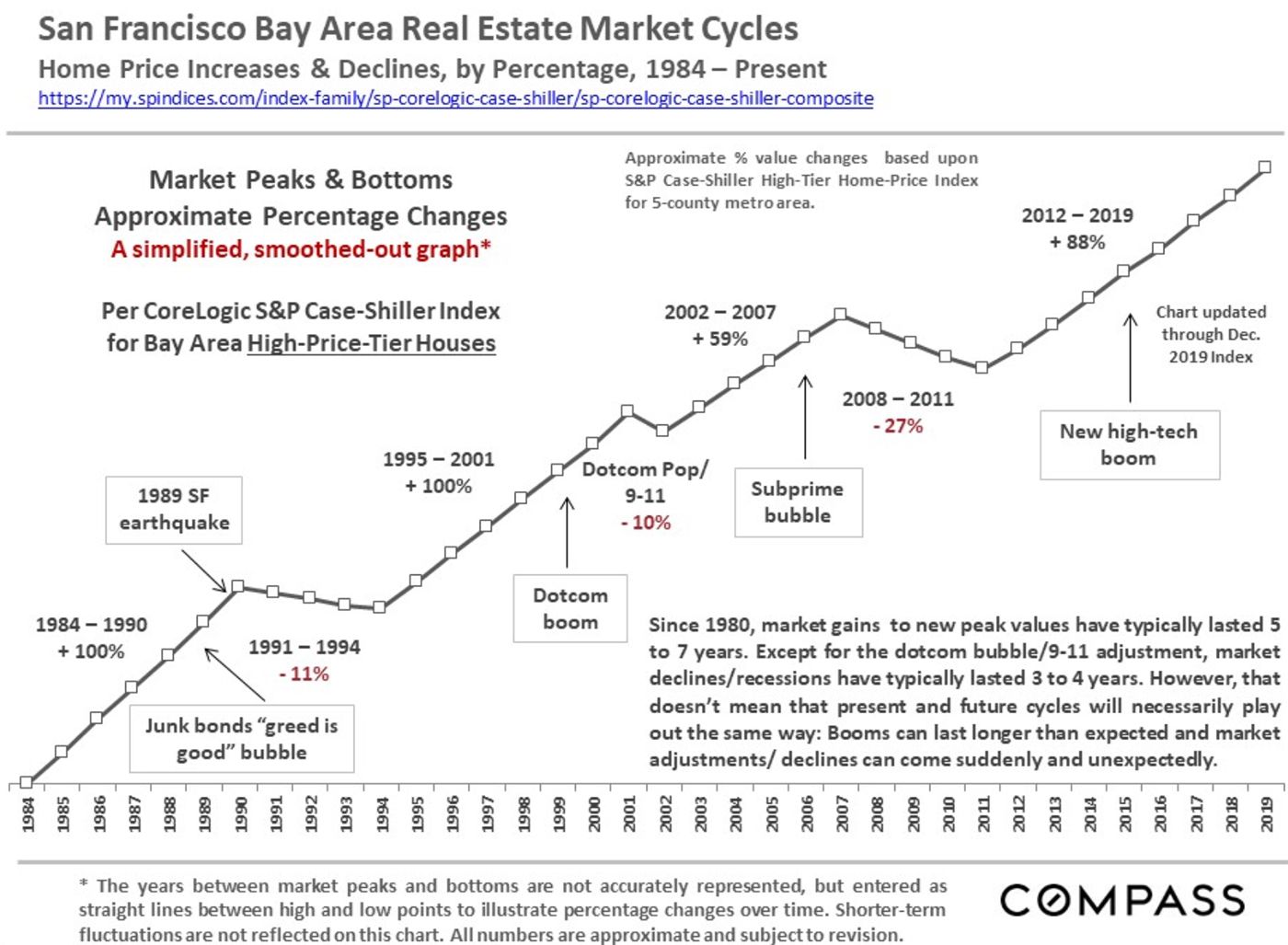

Carlisle was the author of an April report produced by Compass examining the past 30 years of the SF residential real estate market. The straight-line chart below — which does not include the minor, though sometime dramatic fluctuations within a given year — illustrates how robust and consistent the growth in home prices has been since the mid-1980s, with brief recession-related drops that are pretty quickly recovered from.

"All the major recessions in the Bay Area in recent decades have been tied to national or international economic crises, which can take a wide variety of forms," Carlisle writes in the report. "Absent an enormous natural disaster, it is unlikely that a major, negative market adjustment (or 'crash') would occur due simply to local issues. However, local issues can certainly lead to less dramatic market adjustments, or exacerbate a downturn caused by a macro-economic event."

Photo: Richard Price