In 2020, cannabis consumers and the industry navigated the same tectonic changes facing all of America and the world: Covid-19 infections and the challenges of quarantine, massive demonstrations for racial justice, and a tense but watershed U.S. election that ushered in legalization in four more states. How did cannabis consumers respond to this year of crisis? Eaze, as California’s largest legal cannabis marketplace (with 6.5+ million legal deliveries under our belt), can offer unique insights into how 2020 impacted consumption, uncovering patterns that can be generalized to markets nationally and globally.

Eaze’s 2020 State of Cannabis report aggregates our proprietary data to illustrate the behavior of the over 400 thousand customers who purchased via the Eaze platform in 2020. It holds important lessons for all cannabis regulators, businesses, and entrepreneurs about the road ahead. Here are some of the top findings from the report.

#Ad

1. Consumers Relied on Cannabis Delivery During Lockdown

Consumers underscored the importance of cannabis and home delivery access following March 13, when the White House declared a national state of emergency in response to Covid. The State of California and local governments, recognizing the role of cannabis in constituent well-being, wisely designated cannabis delivery as an essential service. This ensured that consumer demand could be met safely at the doorstep, rather than forcing customers into brick and mortar shops.

In the 30 days after March 13, new Eaze customer sign-ups jumped by nearly 60% and the average size and value of every order rose by 15% and 13% respectively. March and April 2020 were the year’s highest months for new deliveries and, overall in 2020, new customer sign-ups increased by 71%.

2. Edibles Shot to #1

In 2020, edibles rose significantly in popularity, especially among new customers. This trend reflects the public health focus on Covid’s respiratory impacts, and a much larger selection of edible products available on the current market.

By the end of 2020, edibles accounted for 22% of all sales and were the most popular product in SF, LA, Oakland, and San Diego. Among first-time customers, edibles’ popularity jumped from 14% to 19% between February and April.

3. Winter Holidays Were Lit

Cannabis made big holiday moves in 2020. While Green Wednesday (the day before Thanksgiving) and 4/20 held onto their #1 and #2 positions respectively, cannabis played a much bigger role during Hanukkah, the days leading up to Christmas, and New Year’s Eve.

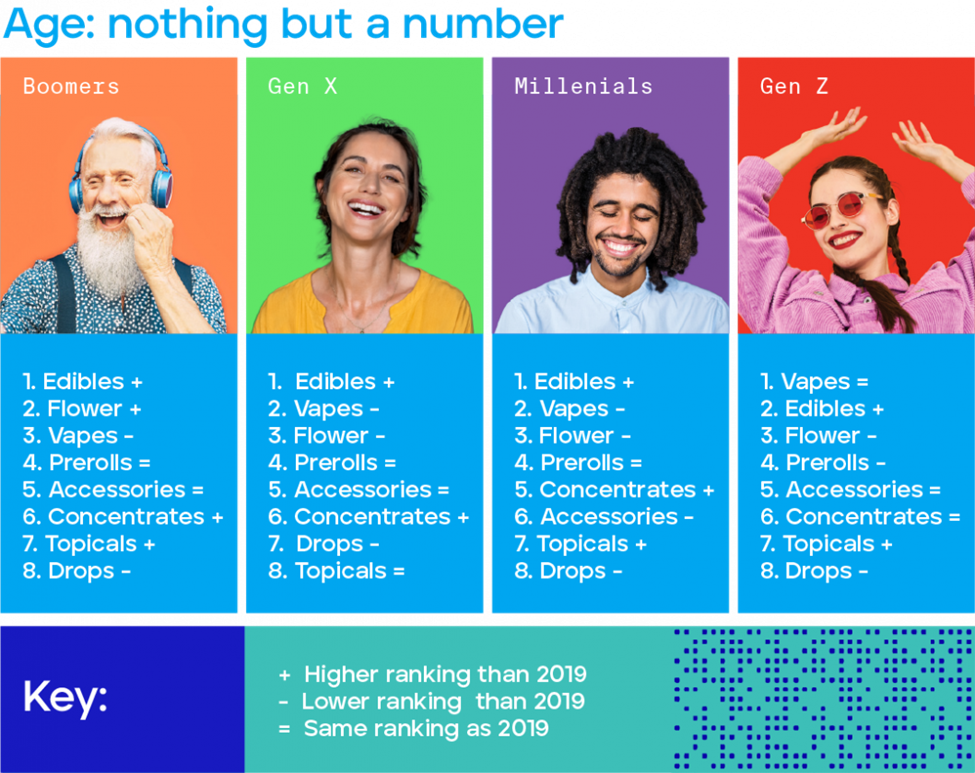

4. Gen Z Stood By Their Vapes

In 2020, edibles, flowers, and vapes were the top three products across all age groups. Edibles rose to first place for Boomers, Gen X, and Millennials, whereas Gen Z preferred vapes. Pre- rolls consistently came in at #4 across all generations. Topicals and concentrates also had a bigger moment. More Boomers, Gen X, and Millennials bought concentrates than in 2019, reflect- ing more practical experience with higher dosing three years into legalization, and topicals became more popular in all age groups except Gen X.

5. Conscious Consumerism Elevated Equity Brands

Today’s cannabis industry is wholly indebted to decades of work and activism by Black and Brown communities; consumers reflected this truth in 2020 by increasingly choosing social equity (SE) brands – products created by licensees from communities negatively or disproportionately impacted by cannabis criminalization.

In 2020, 9.5% of all customers bought SE brands, accounting for $2.6 million in sales. Customers over 30 were more likely to buy SE brands than younger buyers.

6. Cannabis Was a Unifying Political Issue

Cannabis was the clear winner of the 2020 election, with voters approving every national ballot measure to legalize or decriminalize. In three states, weed got more votes than either presidential candidate. Hopes and fears ran high on Election Night, driving an uptick in consumption. On 11/3, compared to all prior Tuesdays in 2020:

● Consumers ordered 12% more product.

● There was a 17% increase in deliveries statewide and an 18% increase in Los Angeles.

● The highest percentage of orders overall was between 2 p.m. and 6 p.m. PT, as Californians prepared to watch East Coast election returns and media broadcasts entered prime time.

7. Location Mattered

What were the most popular neighborhoods in California’s biggest markets? Demand was highest in neighborhoods that might surprise the locals. And, while the majority of consumers are urban dwellers, deliveries to the suburbs now account for a full 20% of sales.