There’s a signature drive to put a 5% “billionaire tax” on the California ballot. It has not collected even one signature, but the billionaires are freaking out on Twitter with grand tantrums saying they will leave the state en masse.

We live in a nation where the richest 1% owns 30% of all wealth in the US. And the system is clearly set up to favor the mega-rich investor class. Billionaire investor Warren Buffett complained for years that he has a lower tax rate than his own secretary, and it has been brought up in many political campaigns that billionaires pay a lower tax rate than teachers and nurses. Billionaires Elon Musk, Jeff Bezos, and George Soros have gone several years paying no federal income taxes whatsoever, contributing to an era of very extreme income inequality that has no precedent in modern times, if not the entire history of human civilization.

To be clear, the Billionaire Tax Act in California is not (just) an unrealized gains tax. It’s a 5% across-the-board confiscation of net worth. It applies even if one has already realized and paid taxes on the entire amount. https://t.co/52FzQJ3qGs

— David Sacks (@DavidSacks) December 27, 2025

Consider in this context a New York Times article published on Friday of last week, saying that some California political activists were working on a ballot measure for a one-time 5% tax on billionaires’ wealth in the state, and how a couple high-profile billionaires are throwing a stink that they will leave California because of it. That Friday article led to a full-blown, four-alarm Christmas weekend marathon of wealthy tech bros throwing massive Twitter tantrums saying that they were going to leave the state of California.

YOU SHOULD BE ABSOLUTELY TERRIFIED RIGHT NOW — THAT IS THE PROPER REACTION TO A BANK RUN & CONTAGION @POTUS & @SecYellen MUST GET ON TV TOMORROW AND GUARANTEE ALL DEPOSITS UP TO $10M OR THIS WILL SPIRAL INTO CHAOS

— @jason (@Jason) March 12, 2023

Wait, aren't these wealthy tech bros the exact same assholes who were just begging for a government bailout when Silicon Valley Bank when belly-up in March 2023? (As seen above.) Yes, these are those exact same assholes. And their Twitter histrionics may be giving this currently theoretical ballot measure’s signature drive the greatest free advertising campaign it could have ever dreamed of.

This story first popped up in the New York Post on December 22, in an article interestingly written by two recent SF Standard staff writers who’ve since moved on to the right-wing Fox News ecosystem. That article quotes YC Combinator CEO Garry Tan (technically not a billionaire, he would not be affected) and one tax advisor, both saying that the billionaires would all leave California if forced to pay higher taxes.

NEWS:

— Teddy Schleifer (@teddyschleifer) December 26, 2025

Larry Page and Peter Thiel are making moves to leave California by the end of the year to avoid a possible billionaires tax that could hit them where it hurts.

With @RMac18 + @hknightsf.https://t.co/VyYtHPRdYQ

The NY Times article came out four days later, and does name specific billionaires' names. It says that Google co-founder Larry Page and straight-to-DVD knockoff Bond villain Peter Thiel were “cutting or reducing their ties to California by the end of the year,” and that this information came “according to five people familiar with their thinking.”

The Times article also notes that Governor Gavin Newsom is dead-set against this billionaire tax, as Newsom too fears that billionaires would flee California.

The thing is, this so-called California Billionaire Tax Act is not even a real ballot proposal yet. The effort has not even collected one single signature to make the 2026 (or whenever) ballot, and it would require 870,000 signatures to do so. The effort is being spearheaded by the SEIU-United Healthcare Workers West labor union.

Who would a California wealth tax impact? Here’s a list of the state’s billionaires https://t.co/OahUSFQydY via @sfchronicle

— Joe Garofoli (@joegarofoli) December 30, 2025

As the Chronicle explains, the measure would impose a one-time 5% tax on any California resident with a net worth of more than $1 billion, with most of the revenue going toward the state’s healthcare system. The Chronicle also lists the 214 current California billionaires who would be hit with the tax. And it would hit billionaires on their favorite accounting trick, by taxing the currently untaxed unrealized capital gains (this is, unsold stock), which is what constitutes most of their mind-boggling fortunes.

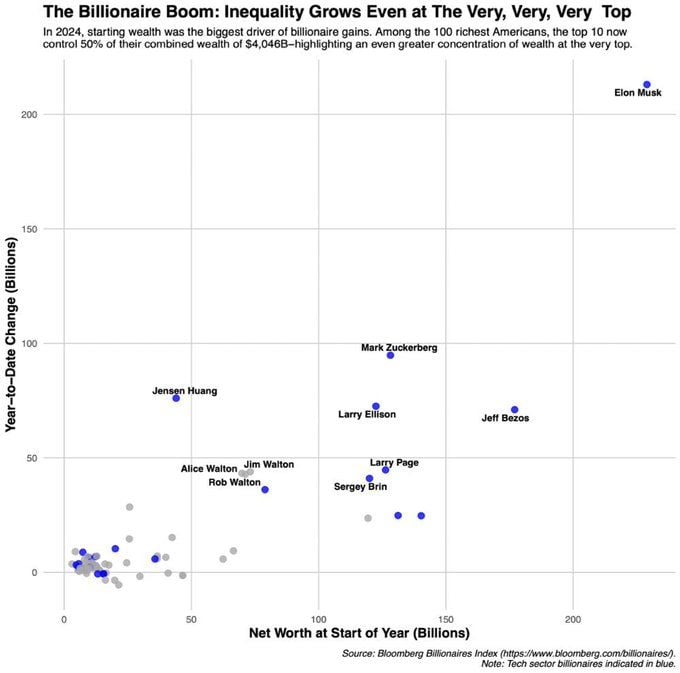

Those mind-boggling fortunes have gotten much larger just in the last year, as billionaires are currently paying no taxes at all on what is by far the largest driver of their ever-growing wealth.

Jeff Bezos and Lauren Sánchez are kicking off the new year in St. Barts. 🎉 pic.twitter.com/G3fHZKrzRh

— Page Six (@PageSix) December 29, 2025

Seriously, maybe some of these people really do have just too much money to throw around?

It’s not a tax, you’re confiscating 5% of people’s assets — which is illegal and will be overturned eventually

— @jason (@Jason) December 27, 2025

Powerful people have a choice of where to live and operate from, and California is driving the best and brightest out of the state

Message received! https://t.co/icYZXq6Jra

And oh, the billionaires and their lickspittles have spent the last five days throwing histrionic tantrums on Twitter, as if paying taxes is “confiscating” when it happens to wealthy people, but perfectly fine when taxation is applied to the middle- and lower-class populations.

We're absolutely going to have to figure out how our society adapts to a rapidly increasing wealth gap, it'll be required to preserve our republic, but the answer is definitely not taxing unrealized gains.

— Alexis Ohanian 🗽 (@alexisohanian) December 28, 2025

Some billionaires have taken a more measured approach to their rage-tweeting, but it’s still pretty clear that taxing unrealized capital gains is literally the billionaires’ worst nightmare.

Peter Thiel is leaving California if we pass a 1% tax on billionaires for 5 years to pay for healthcare for the working class facing steep Medicaid cuts.

— Ro Khanna (@RoKhanna) December 27, 2025

I echo what FDR said with sarcasm of economic royalists when they threatened to leave, "I will miss them very much." https://t.co/5N8FxBqJww

KRON4 notes that Silicon Valley Congressional rep Ro Khanna has jumped into the discourse, supporting the billionaire tax, and jokingly saying of the billionaires threatening to leave, “I will miss them very much.”

Nobody making a stronger case for the billionaire tax than the tech billionaire tantrum right now.

— austerity is theft (@wideofthepost) December 28, 2025

There is some dispute over Rep. Khanna’s claim that this is a “1% tax on billionaires for 5 years.” It is a one-time 5% tax, but people would have five years to pay it. I’m no tax accountant, so I cannot say whether Khanna is distorting the matter.

After blindly funding the Left for years, Silicon Valley is finally realizing what time it is. Dinner time. And they’re on the menu.

— David Sacks (@DavidSacks) December 29, 2025

But the billionaires are fucking furious over this, that is for sure. Above we see diehard Trumper VC David Sacks high on his own supply of the “billionaires are victims” card, and other prominent rich MFs are vowing to primary Ro Khanna out of Congress, as they assume that billionaires and their perspectives somehow have enormous widespread popular public support.

That’s… probably not the case? Which is the funny thing about this Silicon Valley rich people freakout about the proposed billionaire tax. The rich guys’ tantrums are probably doing more to elevate interest in and awareness of the ballot measure and its upcoming signature drive. And they're providing a massive boost of free marketing to the signature-gatherers who will need nearly 900,000 signatures to get this previously far-fetched proposition onto the ballot.

All those tech billionaires threatening to leave California don’t have the social skills to survive outside Silicon Valley tbh

— Zaid Jilani (@ZaidJilani) December 30, 2025

Related: Report: Ron Conway Was Among Venture Capitalists Begging For Silicon Valley Bank Bailout [SFist]

Image: WASHINGTON, DC - JANUARY 20: Guests including Mark Zuckerberg, Lauren Sanchez, Jeff Bezos, Sundar Pichai and Elon Musk attend the Inauguration of Donald J. Trump in the U.S. Capitol Rotunda on January 20, 2025 in Washington, DC. Donald Trump takes office for his second term as the 47th president of the United States. (Photo by Julia Demaree Nikhinson - Pool/Getty Images)