A new report from top SF City Hall economists says that it’s troublesome how the city’s five largest taxpayers pay 25% of all the city’s business taxes, and that remote work changes by top taxpayers companies lowered SF tax revenue by $484 million in 2021.

Hey, remember back in March 2022, when Mayor London Breed joined business owners in a get your ass back to the office campaign, at a time when the U.S. was still seeing an average of about 1,900 COVID-19 deaths per day? We may have some insight into her urgency there. According to a Chronicle writeup of a new report from top city economists, remote work trends in the finance, information, and tech sectors “reduced the city’s tax revenue by $484 million in 2021.”

New SF study found the city lost $484 million in taxes due to remote work across three major sectors including tech.

— Roland Li (@rolandlisf) July 12, 2023

And the 5 biggest taxpayers account for 24% of all business taxes, making the city vulnerable to potential downsizings or relocations: https://t.co/vtzzBzSNUn

But the full 15-page report contains some crucial additional context. “It is important to note this figure is not a real budgetary loss,” says the report from the city’s Treasurer, Controller, and Chief Economist. “At no point did the City’s revenue from (gross receipts tax and homelessness gross receipts tax) decline by that amount. However, the figure can be viewed as a fiscal impact of remote work — revenue that the City was not owed, because office employees are spending less time physically working in San Francisco.”

A new report from our City economic leaders shows the vulnerabilities of our existing tax structure. Remote work, an unstable and narrow tax base, and other challenges require change. Our long-term economic health requires real tax reform. And that’s what we are doing. https://t.co/dhwYYhUviT

— London Breed (@LondonBreed) July 12, 2023

This is all because gross receipts taxes are calculated by how many workers are located in the city, and remote work has cut into that. “In this new era of remote work, the City’s business tax base is already eroding,” the report adds. That could reverse, but at the moment, it’s not reversing very quickly.

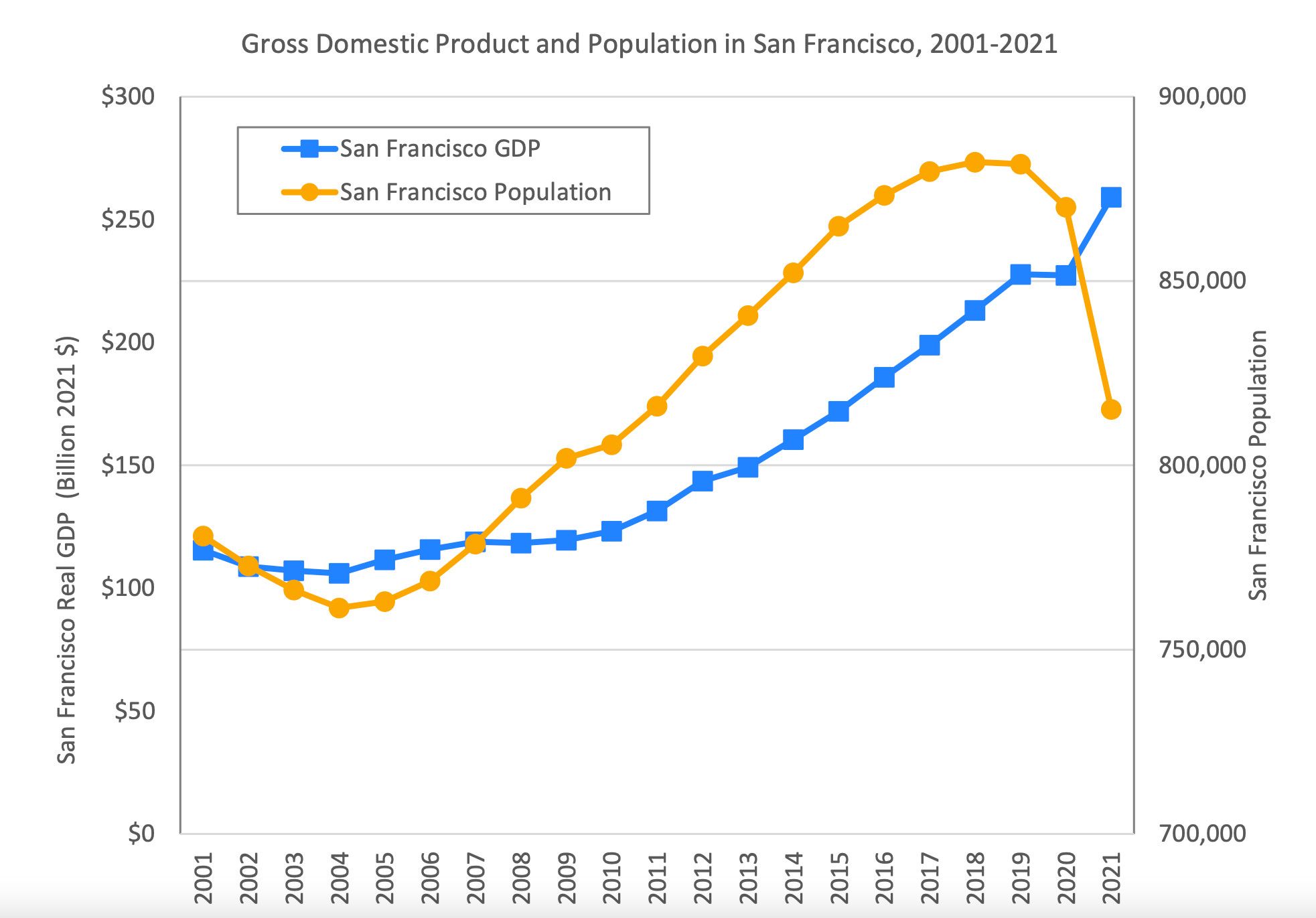

This will all be sold as San Francisco being “anti-business,” and we do have the highest corporate taxes of any California city. But the report also points out that San Francisco’s Gross Domestic Product grew by nearly $25 billion in 2020 and 2021, the largest increase for any county with more than 500,000 residents, despite the population loss. That doesn’t feel very “anti-business.”

San Francisco's top-heavy business taxes place most of the burden on a handful of large firms — and the city is discovering that's a problem. https://t.co/1qojnsZAGo

— San Francisco Business Times (@SFBusinessTimes) July 12, 2023

But there’s still a very big problem here in how our tax base is strongly concentrated among just a few large companies. (These companies are not identified, but you figure it’s companies like Salesforce and Wells Fargo.) The Chron sums this up as “the five largest taxpayers accounted for $339 million in business taxes, or 24% of the total.” The SF Business Times views it a little more broadly by saying “San Francisco relies on just 10 companies for a third of its business tax revenue.”

In 2022, SF's top 5 taxpayers accounted for nearly a quarter of all biz taxes.

— Rafael Mandelman (@RafaelMandelman) July 12, 2023

That makes us uniquely vulnerable when just a few companies move their HQs out of San Francisco. (3/4) pic.twitter.com/YpXaVlcXiY

That means San Francisco’s business tax revenue has all its eggs in a small handful of baskets. That’s a problem if one or two of these companies goes under, or decides to relocate its headquarters to Butte, Montana or something. Supervisor Rafael Mandelman asked for this report, and he’s definitely making political hay of it. And there are sure to be political battles. But this couple-year-old data may be slightly out of date, or also just the inevitable result of monopolization of certain industries, where a few top tech titans essentially control giant chunks of their industries.

And many of those tech titans are based in, or have a huge office presence in San Francisco. At least, they do for now.

Related: Persistent Remote-Work Rules Could Well Kill SF's Downtown Hospitality Scene [SFist]

Image: Sebastien Gabriel via Unsplash