The feared “contagion” from the Silicon Valley Bank collapse has now spread to banks whose branches and ATMs you see around San Francisco, as the SF-based First Republic Bank tanked in the markets over bank-run fears.

We did not wake up Monday morning to a global financial meltdown, which many credible people were saying was a possibility up until the Federal Reserve’s 6:15 p.m. ET Sunday announcement that it would ensure all the deposits for the collapsed Silicon Valley Bank. But further ramifications and unintended consequences still made for a Pepto Bismol Monday morning in some sectors of the markets, namely small regional banks.

And CNBC reports that “San Francisco’s First Republic shares lost 64% on Monday after declining 33% last week,” adding that “PacWest Bancorp dropped 32%, and Western Alliance Bancorp lost more than 50% as regional bank stocks fell sharply. Zions Bancorporation shed 19%, while KeyCorp fell 23%.”

BREAKING: First Republic Bank shares drop by record 67% at the open before trading halted https://t.co/XrG3RVA421 pic.twitter.com/9AIEPMcRTZ

— Bloomberg (@business) March 13, 2023

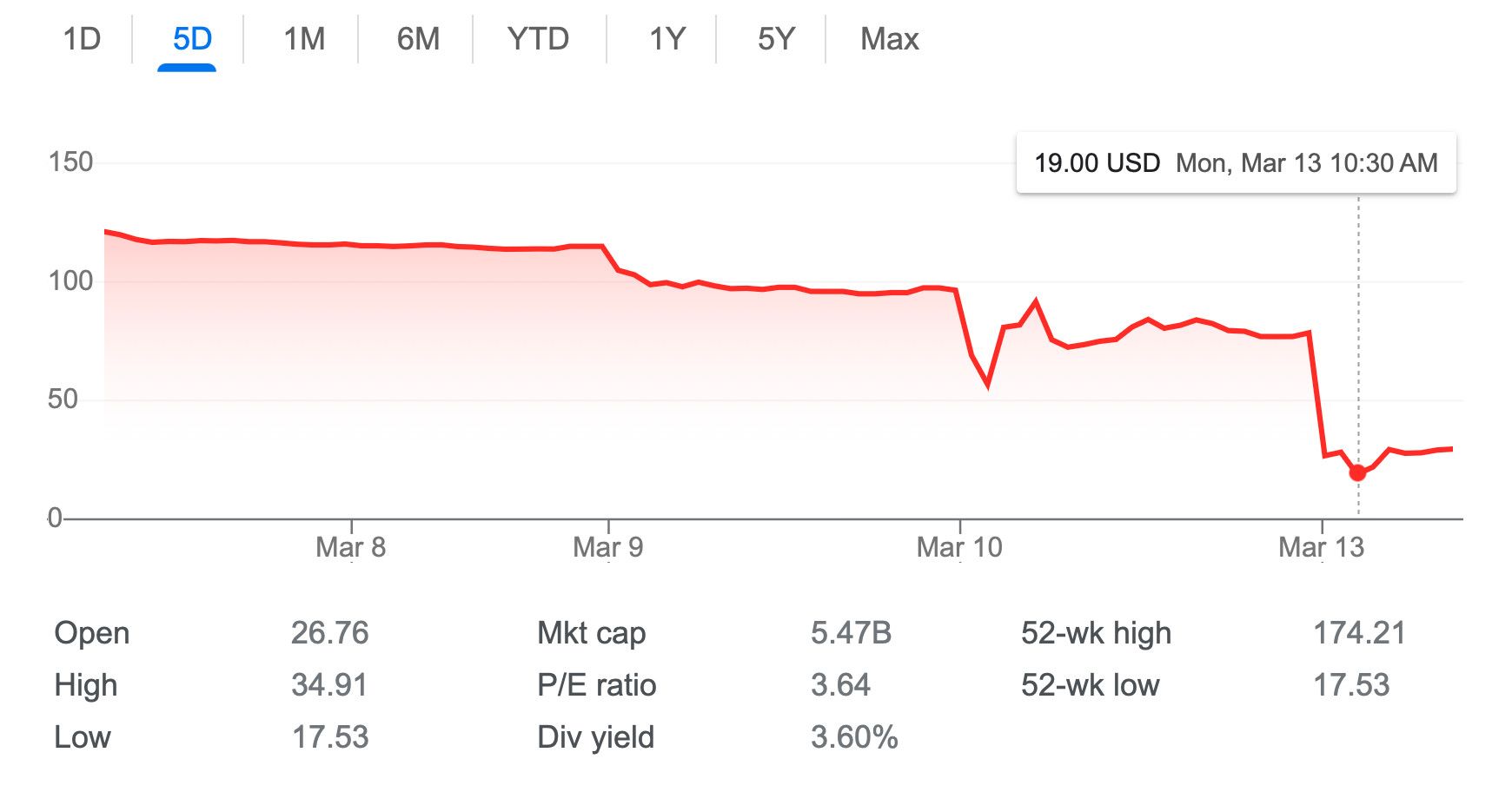

The tweet above gives you a sense of what happened to First Republic’s stock when the market opened Monday morning. According to KPIX, prior to the market opening, shares “fell more than 70% in early trading,” and TechCrunch adds that trading of First Republic shares was halted.

The screenshot above gives you a more detailed sense of what’s happening with the stock, which has rebounded somewhat, and late Sunday they announced a $70 billion infusion from JP Morgan Chase & Co. And as of press time for this post, the stock has bobbed back above $40. But this is a stock that was trading at $82.45 when the market closed on Friday, so yes, still a prodigious collapse.

1/ In light of recent industry events, we want to take a moment to reinforce the safety and stability of First Republic, reflected in the continued strength of our capital, liquidity and operations. https://t.co/idLioxswbn

— First Republic (@firstrepublic) March 12, 2023

CNN obtained an email sent to First Republic clients that’s clearly meant to reassure them.“In light of recent industry events, the last few days have caused uncertainty in the financial markets,” that email said. “We want to take a moment to reinforce the safety and stability of First Republic, reflected in the continued strength of our capital, liquidity and operations.”

Those words are carefully chosen to calm spooked investors. But when you even have to say such things, you know you’re in trouble.

KPIX describes First Republic as having “$213 billion in assets and 7,200 employees.” But this does change the face of this crisis that today’s victim is a bank whose branches and ATMs are a familiar everyday sight to us, rather than some cartoon-villain-named entity like “Silicon Valley Bank.” And the crisis felt averted with Sunday’s Fed infusion toward Silicon Valley Bank’s depositors, but it looks likely there will be additional landmines and "contagion" alarms sounded as this week progresses.

Senator Elizabeth Warren on Monday published a guest essay in the New York Times blaming the collapse of Silicon Valley Bank and the subsequent weekend collapse of NY-based Signature Bank on loosed regulations since 2008, particularly under Trump.

"In 2018, the big banks won," Warren writes. "With support from both parties, President Donald Trump signed a law to roll back critical parts of Dodd-Frank. Regulators, including the Federal Reserve chair Jerome Powell, then made a bad situation worse, letting financial institutions load up on risk."

And, Warren adds, "S.V.B. suffered from a toxic mix of risky management and weak supervision. "

Related: Silicon Valley Bank Collapse Reverberates Through Bay Area Wine Industry, Tech Startups [SFist]

Image: First Republic Bank via Yelp