Amidst a recent uproar that nearly 10% of San Francisco housing stock is (still) just sitting vacant, supervisors Dean Preston kicked off a campaign to get a vacancy tax on this November’s ballot.

When a city report dropped last week showing that nearly 10% of SF housing units are vacant (“40,458 total housing units vacant,” according to the city’s Budget and Legislative Analyst’s Office), it was widely assumed in media coverage that this report would be a prelude to Supervisor Dean Preston kicking off a campaign to get a vacancy tax on the ballot. Barely a week after that report was released, Preston’s vacancy tax campaign is underway. On the steps of City Hall Tuesday morning, Preston and supporters did indeed announce their intention to get that vacancy tax on your November 2022 SF ballot, calling it the “Empty Homes Tax.”

Announcing Empty Homes Tax with a few friends. Let’s do this! pic.twitter.com/JPT61TtxW0

— Dean Preston (@DeanPreston) February 8, 2022

“In a city with a chronic shortage of affordable housing, and more than 8,000 people living on our streets, it is unconscionable that we have tens of thousands of homes sitting empty,” Preston said in a release. “The Empty Homes Tax will incentivize property owners to do the right thing and turn vacant units into places San Franciscans can call home.”

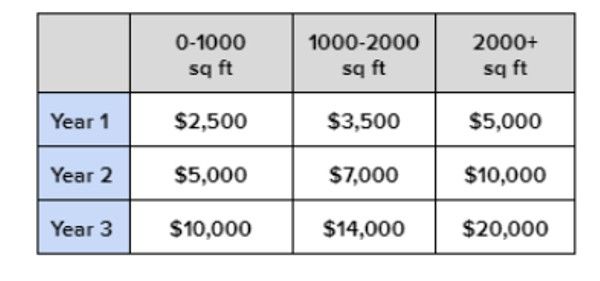

Preston’s office predicts in the release that said vacancy tax would raise “more than $38 million annually,” by taxing owners with three or more vacant units that have been empty for longer than six months. The chart above shows the proposed tax rate. In terms of how this money would theoretically be used, the Chronicle reports that “half of its revenue would fund rental subsidies for seniors and low-income families, while the other half would support a new program to help the city buy empty buildings and convert them into affordable housing.”

This is a tax increase in San Francisco, which means voters would have to approve it. The Empty Homes Tax campaign would need 9,000 valid signatures by July 11 to make the November ballot. The measure would only need a simple majority to pass and implement the tax.

That simple majority is not a foregone conclusion. As NBC Bay Area notes, the legislative analyst’s housing data is from 2019, so opponents will surely call its current accuracy into question. The proposed tax would surely draw the ire of the California Association of Realtors and other large lobbies, so it’s a fair bet that opponents of the tax will significantly outspend supporters of the tax.

And some voters may just feel it's a bad idea. “A vacancy tax makes no sense,” Tenderloin Housing Clinic executive director Randy Shaw told the Chronicle last week. “It creates this false sense that we don’t need to build more housing.”

A few other cities have tried vacancy taxes, sometimes successfully. Preston’s office notes that a 2016 vacancy tax in Vancouver “is credited with bringing more than 18,000 units online since it went into effect.”

That said, San Francisco is not Vancouver (though Hollywood often uses Vancouver as a backdrop to depict San Francisco). Why? Because market forces are different in Vancouver, so it’s cheaper to make a movie there. And that may be an issue for the vacancy tax, too. Some cities may look like San Francisco at first blush, but our economies behave differently. So a San Francisco vacancy tax might not produce the same 18,000 available units that it did in Vancouver.

Related: Report: 10% of San Francisco’s Housing Stock Is Just Sitting Vacant and Empty [SFist]

Image: Belle Co via Pexels